Private Limited Company Registration

Package Starts from Rs.11999 Rs. 8999

- Help you to register your directors with the MCA

- We help you pick the right company name.

- We draft and file (MoA and AoA).

- Get you Documents Ready within 7 days.

Contact Our Experts

We offer the top business professionals that can handle any of your inquiries.

Submit Required Details

Provide the documents, and we'll handle the paperwork for you.

Get Company Registration!

Registration is complete, and the Incorporation certificates will be sent to you.

Private Limited Company Overview

A Private Limited Company (Pvt Ltd) is a type of business structure that limits the liability of its shareholders to the amount of their investment in the company. It is a popular choice for small to medium-sized enterprises due to its flexible structure, limited liability, and ease of operation.

Key Features

Limited Liability:

- Shareholders’ liability is limited to the unpaid amount on their shares. Personal assets of shareholders are protected in case of company debts.

Separate Legal Entity:

- A private limited company is considered a separate legal entity, distinct from its owners. It can own property, enter contracts, and sue or be sued in its name.

Minimum and Maximum Members:

- A minimum of 2 and a maximum of 200 members (shareholders) are allowed. However, there is no limit on the number of employees.

Share Transfer Restrictions:

- Shares cannot be freely transferred to the public, maintaining control within a small group of individuals. This is intended to prevent unwanted takeovers.

No Minimum Capital Requirement:

- There is no requirement for a minimum paid-up capital, making it easier for entrepreneurs to start a business.

Management Structure:

- Managed by a board of directors, which is elected by the shareholders. The directors are responsible for the day-to-day operations of the company.

Compliance Requirements:

- A private limited company is required to adhere to various compliance regulations, including filing annual returns, maintaining statutory registers, and conducting regular board meetings.

Benefits of GST:

Limited Liability Protection:

- Protects personal assets from business debts and liabilities.

Credibility:

- A Pvt Ltd structure enhances credibility with suppliers, customers, and financial institutions.

Tax Benefits:

- Corporate tax rates are often lower than personal income tax rates. Companies can also claim deductions for various business expenses.

Ability to Raise Capital:

- Private limited companies can raise funds through the issuance of shares, attracting investors or venture capital.

Perpetual Succession:

- The company continues to exist independently of changes in ownership or management, ensuring continuity.

Requirement

1. Minimum Requirements

Directors:

- A minimum of two directors is required.

- At least one of the directors must be a resident of India.

Shareholders:

- A minimum of two shareholders is necessary, and the maximum can be 200.

Capital:

- No minimum paid-up capital requirement exists for private limited companies in India.

2. Required Documents

For Directors and Shareholders

Identity Proof:

- A copy of a government-issued identity document, such as:

- Aadhaar card

- Passport

- Voter ID

- Driver’s license

- A copy of a government-issued identity document, such as:

Address Proof:

- A document proving the residential address of directors/shareholders, such as:

- Utility bill (electricity, water, etc.)

- Bank statement

- Rent agreement

- The address proof must be current and not older than three months.

- A document proving the residential address of directors/shareholders, such as:

Passport-sized Photographs:

- Recent passport-sized photographs of the directors/shareholders.

For the Company

Memorandum of Association (MoA):

- A legal document stating the company’s objectives, name, registered office address, and share capital.

Articles of Association (AoA):

- A document outlining the internal regulations and management of the company.

Registered Office Address Proof:

- Proof of the registered office, which could include:

- Rent agreement (if rented)

- Sale deed (if owned)

- No Objection Certificate (NOC) from the property owner (if applicable).

- Proof of the registered office, which could include:

Digital Signature:

- A digital signature certificate (DSC) for the proposed directors is required for e-filing.

Director Identification Number (DIN):

- Each director must obtain a DIN, which is a unique identification number assigned by the Ministry of Corporate Affairs (MCA).

Types

By Ownership Structure:

- Single Person Pvt Ltd: Owned by a single individual.

- Multi-Member Pvt Ltd: Owned by two or more members.

By Nature of Business:

- Service-Based: Focused on providing services (e.g., consulting, IT).

- Product-Based: Engaged in manufacturing or selling products.

By Industry:

- IT/Software: Involved in software development and tech services.

- Manufacturing: Produces goods across various sectors.

- E-commerce: Operates online sales platforms.

By Registration Status:

- Non-Government: Owned by private individuals or entities.

- Government: Majority ownership by the government.

By Liability Structure:

- Limited by Shares: Shareholder liability is limited to unpaid shares.

- Limited by Guarantee: Liability limited to a guaranteed amount.

By Special Purpose:

- Non-Profit: Operates for social causes, not for profit.

- Holding Company: Controls one or more subsidiary companies.

- Subsidiary Company: Owned or controlled by a parent company.

Document

1.For Directors and Shareholders

Identity Proof:

- A government-issued identity document such as:

- Aadhaar Card

- Passport

- Voter ID

- Driver’s License

- A government-issued identity document such as:

Address Proof:

- Recent utility bill (electricity, water, etc.) or bank statement.

- Rent agreement (if applicable) or sale deed (if the property is owned).

Passport-Sized Photographs:

- Recent passport-sized photographs of all directors and shareholders.

2. For the Company

Memorandum of Association (MoA):

- A document stating the company’s objectives, name, registered office address, and share capital.

Articles of Association (AoA):

- A document outlining the internal rules and regulations for managing the company.

Registered Office Address Proof:

- Proof of the registered office address, such as:

- Rent agreement or property ownership documents.

- No Objection Certificate (NOC) from the property owner if the office is rented.

- Proof of the registered office address, such as:

Digital Signature Certificate (DSC):

- Required for e-filing by the proposed directors.

Director Identification Number (DIN):

- Each director must obtain a DIN, which is a unique identification number assigned by the Ministry of Corporate Affairs (MCA).

3. Additional Documents (if applicable)

Bank Account Statement:

- Recent bank statement for the proposed registered office address.

NOC from Property Owner:

- If the registered office is rented, a NOC from the property owner is needed.

Details of the Proposed Business:

- Brief description of the business activities to be undertaken.

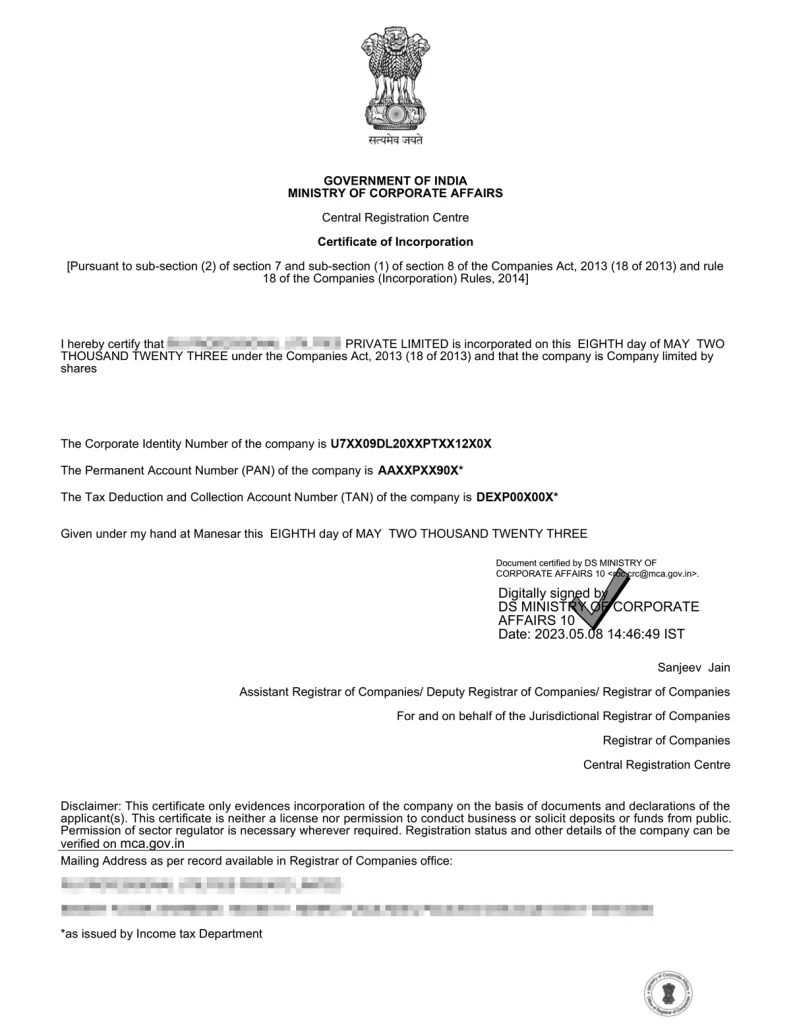

Sample Certificate

FAQs

A Private Limited Company (Pvt Ltd) is a business entity that limits the liability of its shareholders to the amount of their investment in the company. It is distinct from other business structures like sole proprietorships and partnerships.

A minimum of two directors and two shareholders is required to form a Private Limited Company. There can be a maximum of 200 shareholders.

The process includes:

- Name reservation

- Preparation of Memorandum of Association (MoA) and Articles of Association (AoA)

- Filing with the Registrar of Companies (RoC)

- Obtaining a Certificate of Incorporation

Key advantages include:

- Limited liability protection for shareholders

- Separate legal entity status

- Enhanced credibility with customers and suppliers

- Ability to raise capital through equity financing

Ownership is transferred by selling or transferring shares, which is governed by the company’s Articles of Association and requires consent from the board.

Directors are responsible for managing the company’s affairs, making decisions, and ensuring compliance with legal obligations.