Apply for LLP Registration

Package Starts from Rs.14999 Rs. 8999

- Reserving LLP name

- Fastest LLP Company Registration Portal

- Complete support on opening a current Account

Contact Our Experts

We offer the top business professionals that can handle any of your inquiries.

Submit Required Details

Provide the documents, and we'll handle the paperwork for you.

Get LLP Registration!

Registration is complete, and the Incorporation certificates will be sent to you.

Limited Liability Partnership (LLP) Overview

A Limited Liability Partnership (LLP) is a hybrid business structure that combines the benefits of a partnership and a company. It offers flexibility in management, similar to a traditional partnership, while providing limited liability protection to the partners. Introduced in India under the Limited Liability Partnership Act, 2008, an LLP is a popular choice for professionals, small businesses, and startups.

Key Features of LLP

Limited Liability Protection:

- In an LLP, the liability of each partner is limited to the amount they have invested in the business. This protects personal assets from business debts or liabilities.

Separate Legal Entity:

- An LLP is a distinct legal entity, separate from its partners. It can own property, sue, and be sued in its own name.

Flexible Management:

- The internal structure and management of an LLP are governed by a mutual agreement between partners, giving them the flexibility to define roles, responsibilities, and profit-sharing.

No Minimum Capital Requirement:

- There is no mandatory minimum capital required to form an LLP, making it easier for smaller businesses to set up.

Unlimited Partners:

- While there must be a minimum of two partners, there is no cap on the maximum number of partners an LLP can have.

Perpetual Succession:

- An LLP continues to exist irrespective of changes in its partners. The exit or death of a partner does not affect the business’s continuity.

Tax Benefits:

- LLPs enjoy tax benefits, including exemptions from Dividend Distribution Tax (DDT) and provisions for the distribution of profits without additional tax liabilities.

Compliance Requirements:

- LLPs have fewer compliance obligations compared to private limited companies. However, they must file annual returns and financial statements with the Registrar of Companies (RoC).

Benefits

- Limited Liability: Protects personal assets; partners are only liable up to their contribution.

- Separate Legal Entity: The LLP can own property, sue, and be sued independently of its partners.

- Flexible Management: Partners can define roles and responsibilities through an agreement.

- Fewer Compliance Requirements: LLPs have lower regulatory burdens and audit requirements.

- No Minimum Capital: No minimum capital needed, making it ideal for small businesses and startups.

- Perpetual Existence: The LLP continues despite changes in partners, ensuring business continuity.

Requirements

- Minimum 2 Partners: At least one partner must be an Indian resident.

- Designated Partners: At least two designated partners with a DPIN/DIN.

- Digital Signature Certificate (DSC): Required for all designated partners.

- Unique LLP Name: Must end with “LLP” and be distinct.

- LLP Agreement: Agreement detailing roles, responsibilities, and profit-sharing.

- Registered Office: Must have a physical address in India.

- No Minimum Capital: Capital contribution to be disclosed but no set minimum.

Types

1.General LLP

- The most common type of LLP.

- Formed for any legal business purpose (such as service-based businesses, consulting, or trading).

- All partners share the rights to manage the business but with limited liability.

2. Professional LLP

- Formed by professionals like lawyers, accountants, doctors, architects, or other specialized service providers.

- Allows professionals to come together under a legally recognized business entity while maintaining personal liability protection.

3. Family LLP

- Set up by family members, often for managing family-owned businesses.

- It helps family members manage and operate a business while ensuring the personal assets of family members are protected.

4. LLP with Foreign Partners

- An LLP can have foreign nationals as partners, but one partner must be a resident of India.

- It allows global businesses to operate in India under an LLP structure.

5. Start-up LLP

- Specifically formed for start-ups and entrepreneurs.

- Offers flexibility and minimal compliance requirements, making it easier for start-ups to manage their business and grow.

Documents

For Partners:

- PAN Card (mandatory for Indians)

- Address Proof: Utility bill, bank statement, or voter ID

- Passport-sized Photo

- Digital Signature Certificate (DSC)

- DIN/DPIN (for designated partners)

For LLP:

- Proposed LLP Name

- LLP Agreement (defining roles and responsibilities)

- Registered Office Proof: Rental agreement or utility bill

- No Objection Certificate (NOC) from the property owner (if applicable)

Additional (if foreign partner):

- Passport and overseas address proof

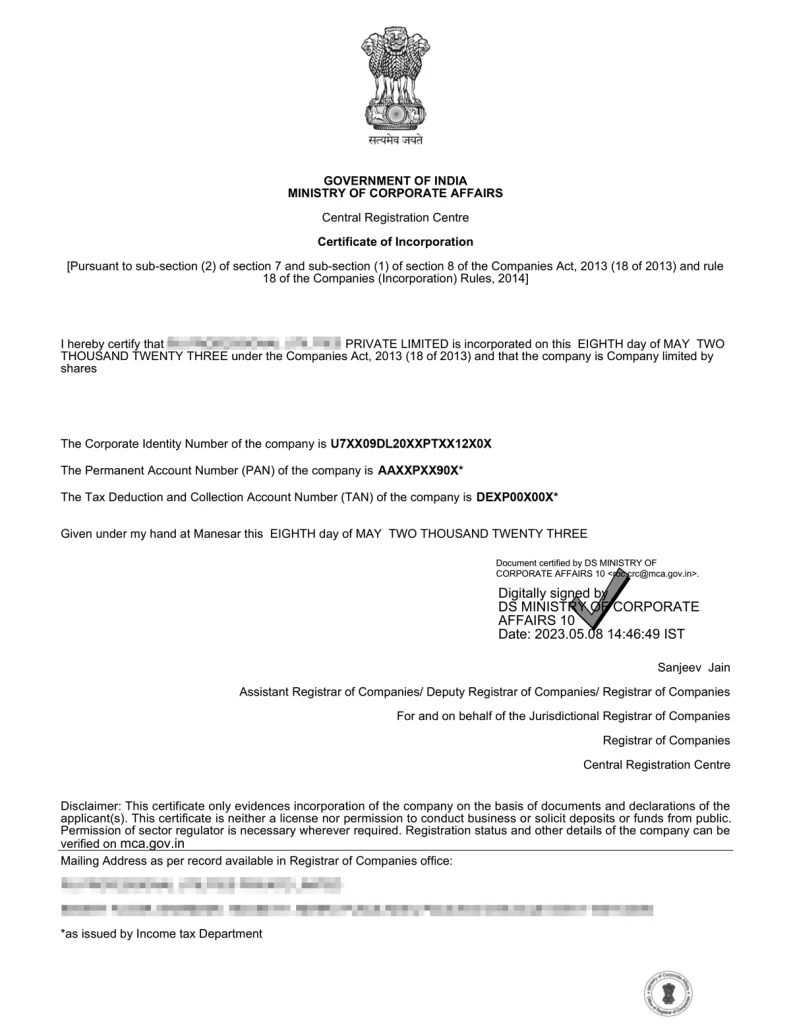

Sample Certificate

FAQs

A Limited Liability Partnership (LLP) is a business structure that combines the benefits of a partnership with limited liability protection. It provides flexibility in management while limiting partners’ personal liabilities to their contributions in the business.

In an LLP, partners have limited liability but greater flexibility in managing the business. Unlike private limited companies, LLPs are not required to hold board meetings, and their compliance requirements are simpler. However, LLPs cannot raise equity capital through shares.

A minimum of two partners is required to form an LLP. There is no upper limit on the number of partners.

Yes, foreign nationals and foreign companies can become partners in an LLP. However, at least one designated partner must be a resident of India.

No, there is no minimum capital requirement for an LLP. Partners can contribute capital in cash, property, or other assets as per their agreement.